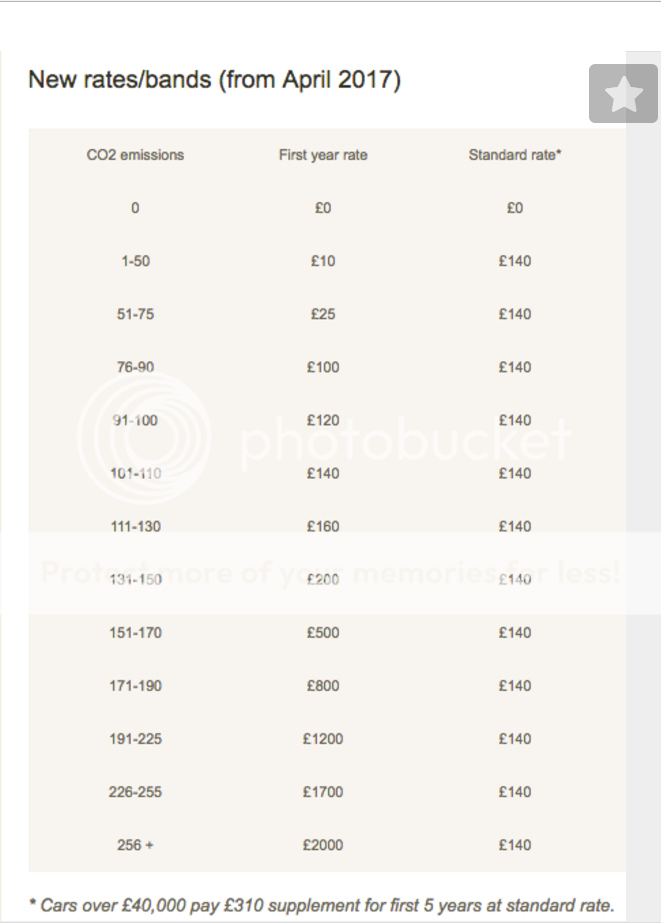

I had an e-mail from my dealer today saying 'beat the vehicle tax rate increases buy before April and save £1000's'. Well I thought that the new rate was £140 p/a and only much higher for vehicles costing over £40000 so what's the dealer up to? I'd missed this one completely. Looking at the tax tables on the Gov.UK site, the first year is based on CO2 emissions, so at 144 g/km our new Yeti will cost £200 for the first year then £140. I won't go into more details but top-end rates are excessively high, although I don't suppose high wealth individuals care much anyway.

Vehicle tax changes

Jimmy

Discussion starter

5,378 posts

·

Joined 2014

- Add to quote Only show this user

I had an e-mail from my dealer today saying 'beat the vehicle tax rate increases buy before April and save £1000's'. Well I thought that the new rate was £140 p/a and only much higher for vehicles costing over £40000 so what's the dealer up to? I'd missed this one completely. Looking at the tax tables on the Gov.UK site, the first year is based on CO2 emissions, so at 144 g/km our new Yeti will cost £200 for the first year then £140. I won't go into more details but top-end rates are excessively high, although I don't suppose high wealth individuals care much anyway.

8,317 posts

·

Joined 2014

Those that buy very high polluting cars costing under £40,000 after 1st April 2017 and intending to keep them for a number of years will be laughing,

We'll be keeping our £30 a year road tax Yeti for quite a while yet

![Image]()

We'll be keeping our £30 a year road tax Yeti for quite a while yet

8,822 posts

·

Joined 2015

Remarkable for a Conservative government to introduce a tax that hits the rich more than pensioners or the "squeezed in the middle" sectors. Oops - I'm straying into politics.......

88 posts

·

Joined 2016

If I was buying a new car, I would expect the dealer to pay for the first years tax anyways!!!!!!

3,272 posts

·

Joined 2014

1,284 posts

·

Joined 2011

After the first year it would be £5 cheaper than what I am paying now (£145)Reckon dealers would sub the extra if it helped selling more cars.

442 posts

·

Joined 2015

Its been said many times 'stick it on the road fuel at the garage' the more you drive the more you pay.

Why should a retired person on a fixed income pay the same as a CEO driving around in a Range Rover?

I have read that if you pay over 40k for an electric car you pay the same rate as a fossil fuel burner- so this has nothing to do with saving the planet or cutting down on pollution its just the GOV trying to get back all the duty from cars only paying 30 pound a year or zero.

Why should a retired person on a fixed income pay the same as a CEO driving around in a Range Rover?

I have read that if you pay over 40k for an electric car you pay the same rate as a fossil fuel burner- so this has nothing to do with saving the planet or cutting down on pollution its just the GOV trying to get back all the duty from cars only paying 30 pound a year or zero.

3,272 posts

·

Joined 2014

Quite correct as I understand it. £40K is the break point. ANYTHING over £40K gets clobbered.Interestingly there is huge annoyance being caused on the Kodiaq forum because if you buy the 'Edition' and then add loads of goodies it goes over £40K

So, for example, you load your Kodiaq up with goodies and get it to £39,920 then add front and rear mudflaps £104 (for the 2 sets) = £40,024. The extra £24 over the threshold will actually cost you £1,550 EXTRA VED over 5 years PLUS of course the first year fee which depends on which engine and how 'dirty' it is AND the £140 a year.

Nice one Osborne, you little sh*t!

![Image]()

I should hasten to add that being a stingy s*d and having spec'd it up to exactly what I want, I am only paying £29,650 (after discount

![Image]()

) so to you Osborne!

to you Osborne!

The new VED rate per annum from year 2 on is the same as the old rate for the 1.4 150bhp DSG with ACT. (which is what I have ordered) and of course the £200 first year charge for that engine is in the on road price of the car.

Edited by: Colin Lambert

So, for example, you load your Kodiaq up with goodies and get it to £39,920 then add front and rear mudflaps £104 (for the 2 sets) = £40,024. The extra £24 over the threshold will actually cost you £1,550 EXTRA VED over 5 years PLUS of course the first year fee which depends on which engine and how 'dirty' it is AND the £140 a year.

Nice one Osborne, you little sh*t!

I should hasten to add that being a stingy s*d and having spec'd it up to exactly what I want, I am only paying £29,650 (after discount

The new VED rate per annum from year 2 on is the same as the old rate for the 1.4 150bhp DSG with ACT. (which is what I have ordered) and of course the £200 first year charge for that engine is in the on road price of the car.

Edited by: Colin Lambert

2,477 posts

·

Joined 2011

UUUMMM that means i will be paying road tax on my mowers, chainsaw, strimmer, hedge cutter. but they don't go on the roadEVOTRIANGLE said:Its been said many times 'stick it on the road fuel at the garage' the more you drive the more you pay.

Why should a retired person on a fixed income pay the same as a CEO driving around in a Range Rover?

I have read that if you pay over 40k for an electric car you pay the same rate as a fossil fuel burner- so this has nothing to do with saving the planet or cutting down on pollution its just the GOV trying to get back all the duty from cars only paying 30 pound a year or zero.

92 posts

·

Joined 2015

Tough, but I think the basic premise makes sense. It also means that no-one can dodge paying it. Thus making more income and saving on the cost of policing it.wakev said:UUUMMM that means i will be paying road tax on my mowers, chainsaw, strimmer, hedge cutter. but they don't go on the roadEVOTRIANGLE said:Its been said many times 'stick it on the road fuel at the garage' the more you drive the more you pay.

Why should a retired person on a fixed income pay the same as a CEO driving around in a Range Rover?

I have read that if you pay over 40k for an electric car you pay the same rate as a fossil fuel burner- so this has nothing to do with saving the planet or cutting down on pollution its just the GOV trying to get back all the duty from cars only paying 30 pound a year or zero.![Image]() .

.![Image]()

![Image]()

steve

2,477 posts

·

Joined 2011

That will mean my machines will be paying more tax than some car's do so can't see how this would be fair, as said they don't go on the road. And customer's won't like paying more on for the workPaper Plane said:Tough, but I think the basic premise makes sense. It also means that no-one can dodge paying it. Thus making more income and saving on the cost of policing it.wakev said:UUUMMM that means i will be paying road tax on my mowers, chainsaw, strimmer, hedge cutter. but they don't go on the roadEVOTRIANGLE said:Its been said many times 'stick it on the road fuel at the garage' the more you drive the more you pay.

Why should a retired person on a fixed income pay the same as a CEO driving around in a Range Rover?

I have read that if you pay over 40k for an electric car you pay the same rate as a fossil fuel burner- so this has nothing to do with saving the planet or cutting down on pollution its just the GOV trying to get back all the duty from cars only paying 30 pound a year or zero.![Image]() .

.![Image]()

![Image]()

steve

3,272 posts

·

Joined 2014

Your order form includes a charge for first year road tax and registration fee. It's called the 'the on the road price'.

293 posts

·

Joined 2015

Of course, if Skoda took the unwanted (and never to be used)third row of seats out and dropped the price accordingly*, you could have lots more extras without breaking the 40K limit.Colin Lambert said:Quite correct as I understand it. £40K is the break point. ANYTHING over £40K gets clobbered.Interestingly there is huge annoyance being caused on the Kodiaq forum because if you buy the 'Edition' and then add loads of goodies it goes over £40K

So, for example, you load your Kodiaq up with goodies and get it to £39,920 then add front and rear mudflaps £104 (for the 2 sets) = £40,024. The extra £24 over the threshold will actually cost you £1,550 EXTRA VED over 5 years PLUS of course the first year fee which depends on which engine and how 'dirty' it is AND the £140 a year.

Nice one Osborne, you little sh*t!![Image]()

I should hasten to add that being a stingy s*d and having spec'd it up to exactly what I want, I am only paying £29,650 (after discount) so![Image]()

to you Osborne!

The new VED rate per annum from year 2 on is the same as the old rate for the 1.4 150bhp DSG with ACT. (which is what I have ordered) and of course the £200 first year charge for that engine is in the on road price of the car.

Just sayin'

Have fun,

Ian.

* The extra seats in low trim (ie MNOT leather) are a £1000 option, leather trim would only make them more expensive.

3,272 posts

·

Joined 2014

Your order form includes a charge for first year road tax and registration fee. It's called the 'the on the road price'.

3,272 posts

·

Joined 2014

Ian, couldn't agree more. It really P'd me orf! I needed what the SE L gave me, but i will never, ever use the 6th&7th seats. So I have wasted a grand. I just hope MEADENS are correct, that when I come to P/x it, I will get a better price but sod's law will ensure it is nowhere near a grand.

![Image]()

Edited by: Colin Lambert

Jimmy

Discussion starter

5,378 posts

·

Joined 2014

Our new Yeti has arrived at the dealer. The CO2 emissions are 144g/km. If it is registered on March 31st under the old VED rates it will be taxed at £145 per annum ie £435 over 3 years, although the March proportion ie £12 is 'lost'. If it is taxed on April 1st the cost over three years is £200 year 1 and a total of £280 years 2 and 3 ie a total of £480. I calculate a saving of £33. Are my calculations correct?

1,284 posts

·

Joined 2011

Tax rates for cars reg'd before April 2017 have gone up today so an existing 1.2 petrol is now paying £150. or £450 over the next 3 years but this could increase further.A new 1.2 petrol from today over the next 3 years will pay £480. so costing just £30 more.

1,686 posts

·

Joined 2017

Current Yeti Greenline would be £30/year and a new version would be £140, so I have ordered the 150PS car now which would have been that before anyway, as I need the car from July.

Interestingly the ford mustang was £1150/year and I used to snigger whenever I saw one, but now is only £140/year, albeit a £2000 sting in the first year but much cheaper in the long run. (Maybe a 5lt+ convertible for summer use might be fun?) Whose going to stump up for a used one now with that annual road tax of £1150 continuing indefinitely?

Edited by: ken3966

Interestingly the ford mustang was £1150/year and I used to snigger whenever I saw one, but now is only £140/year, albeit a £2000 sting in the first year but much cheaper in the long run. (Maybe a 5lt+ convertible for summer use might be fun?) Whose going to stump up for a used one now with that annual road tax of £1150 continuing indefinitely?

Edited by: ken3966

3,272 posts

·

Joined 2014

VED on cars registered BEFORE 1st April 2017 remain THE SAME! vehicles registered from TODAY pay a first year tax depending on their co2 & extra if costing over£40,000 Then ALL cars pay £140p.a. Over£40,000 have extra annual tax plus the £140.RickT said:Tax rates for cars reg'd before April 2017 have gone up today so an existing 1.2 petrol is now paying £150. or £450 over the next 3 years but this could increase further.A new 1.2 petrol from today over the next 3 years will pay £480. so costing just £30 more.

Only pure electric cars pay zero. Hybrids pay extra as above for first year then £130 P.a.

So 1.2 Yeti with 110bhp engine reg BEFORE 1 ST APRIL 2017 WILL CONTINUE TO PAY £110p.a.

I know because I have just retaxed mine TODAY!

570 posts

·

Joined 2016

The system for charging VED on vehicles first registered before April 2017 (the old system essentially) remains the same. The cost of the VED for those vehicles has gone up. Mine was £20 per year last December, and it's now £30

8,317 posts

·

Joined 2014

I don't understand that, saying it stays the same and then saying it changes.Viking said:The system for charging VED on vehicles first registered before April 2017 (the old system essentially) remains the same. The cost of the VED for those vehicles has gone up. Mine was £20 per year last December, and it's now £30

What Skoda was on £20 road tax?

I thought the Greenline was the cheapest at £30 after the first free year.

1,284 posts

·

Joined 2011

Colin Lambert said:VED on cars registered BEFORE 1st April 2017 remain THE SAME! vehicles registered from TODAY pay a first year tax depending on their co2 & extra if costing over£40,000 Then ALL cars pay £140p.a. Over£40,000 have extra annual tax plus the £140.RickT said:Tax rates for cars reg'd before April 2017 have gone up today so an existing 1.2 petrol is now paying £150. or £450 over the next 3 years but this could increase further.A new 1.2 petrol from today over the next 3 years will pay £480. so costing just £30 more.

Only pure electric cars pay zero. Hybrids pay extra as above for first year then £130 P.a.

So 1.2 Yeti with 110bhp engine reg BEFORE 1 ST APRIL 2017 WILL CONTINUE TO PAY £110p.a.

I know because I have just retaxed mine TODAY!

Colin,

My yeti is in Band F, registered in 2014 so before 1st April 2017, it used to be £145 but from today its now £150

Retaxed my motorcycle today and that has increased since I got the reminder letter a couple of weeks ago.

1,686 posts

·

Joined 2017

My wifes fabia 1.6 tdi is £20/yr, and will remain so for its working life

570 posts

·

Joined 2016

There's been no fundamental change to the way the VED is charged. Emissions are all staying in the same band, so a car which produces 110 g/Km will still remain in Band B for VED purposes. But the amount you pay for a vehicle in Band B has gone up from £20 per year to £30 per year.Urrell said:I don't understand that, saying it stays the same and then saying it changes.Viking said:The system for charging VED on vehicles first registered before April 2017 (the old system essentially) remains the same. The cost of the VED for those vehicles has gone up. Mine was £20 per year last December, and it's now £30

What Skoda was on £20 road tax?

I thought the Greenline was the cheapest at £30 after the first free year.

My Octavia is in Band B and used to be £20 per year, but since the price increase it now costs £30 per year.

7,060 posts

·

Joined 2011

Just taxed the Lomax; £150, although I shall probably SORN it in October and claim a refund

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

- posts

- 171K

- members

- 17K

- Since

- 2011

A forum community dedicated to Skoda Yeti owners and enthusiasts. Come join the discussion about performance, classifieds, troubleshooting, repairs, maintenance, and more!

Explore Our Forums